pay my past due excise tax massachusetts

You can pay online by mail or at the Registry of Motor Vehicles. The current excise tax rate for motor vehicles is 25 per 1000 of your vehicles value.

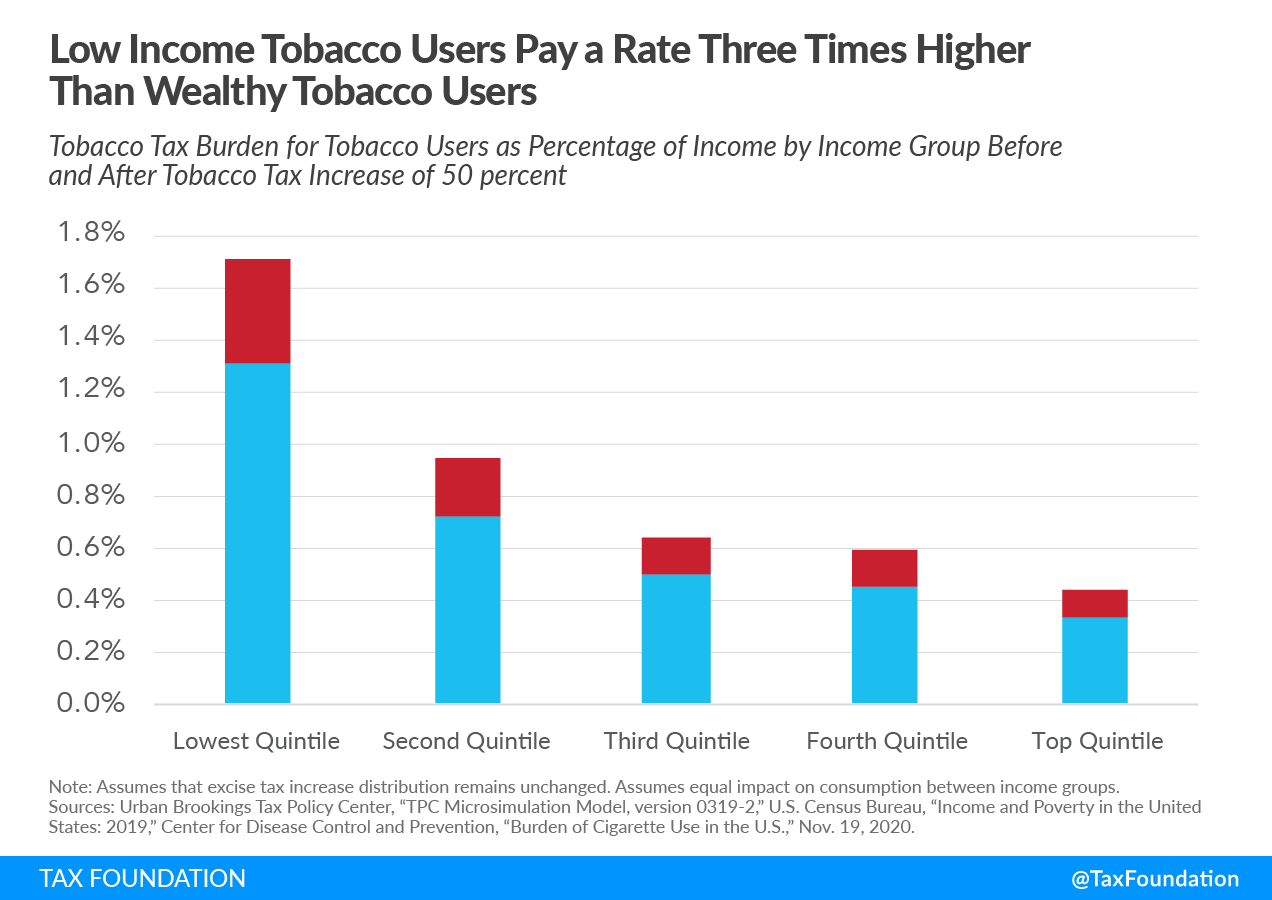

Excise Taxes Excise Tax Trends Tax Foundation

Bills that are more than 45 days past due are.

. According to MGL excise bills must be mailed out 30 days before the due date thus providing 30 days for the principal balance to be paid. Pay Past Due Excise Tax Bills. Online Payment Search Form.

Excise tax payments are due 30 days from the original date of the bill after which a demand bill will be sent out with interest and penalty. Drivers License Number Do not enter vehicle plate numbers. For payment of past due excise taxes please contact the Collectors Office or Jeffery Jeffery prior to making payment.

All owners of motor vehicles must pay an excise tax. This information will lead you to The State. How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal.

We strongly encourage you to pay your Excise tax bills online or by dropping the check and bill in the outside dropbox on the circle driveway at. If you dont make your payment within 30 days of the date the City issued the excise tax interest and fees are added to your bill. Click on Motor Vehicle Excise Tax if you want further information concerning Excise Tax.

Payment of the motor vehicle excise is due 30 days from the date the excise bill is issued not mailed. Massachusetts Motor Vehicle Excise Tax Information. THIS FEE IS NON-REFUNDABLE.

How do I pay my excise tax in Randolph MA. The tax will be delivered to the same address that. Therefore it is the responsibility of the owner to contact the local assessor if heshe has not received a bill.

If you want to pay your. Payment at this point must be made through our Deputy Collector Kelley. If you are unable to find your bill try searching by bill type.

Motor Vehicle Excise Tax bills are due in 30 days. If you dont make your payment within 30 days of the date the City issued the excise tax interest and fees are added to your bill. If the bill goes unpaid interest accrues at 12 per annum.

A person who does not receive a bill is still liable for the. Find your bill using your license number and date of birth. PAY YOUR BILL ON TIME.

Please note all online payments will have a 45 processing fee added to your total due. All outstanding excise taxes must be paid in order to be released. Penalties for Non-Payment If an.

Nonpayment of a bill triggers a demand bill to be produced and a. WE DO NOT ACCEPT. Excise tax demand bills are due 14.

Treasurer Collector Town Of Danvers

Overdue Excise Tax Warrants Acushnet Ma

Online Bill Payment Town Of Dartmouth Ma

Did You Know Motor Vehicle Excise Tax

2021 Motor Vehicle Excise Tax Bills Fairhavenma

Do You Report Paid Excise Tax In Massachusetts

Baker Wants To Hike Excise Tax To Fight Climate Change Others Say It Should Help Housing Crisis Wbur News

Excise Tax Information Templeton Ma Official Government Website

Pay Your Bills Online Winthropma

Excise Assessor S Office City Of New Bedford Official Website

Edelstein Company Llp Tax Alert Massachusetts Enacts Elective Pass Through Entity Excise

Town Of Fairhaven Collector S Office Reminder Excise Tax Bills Were Mailed On February 7 2019 And Are Due On March 8 2019 If You Have Not Received Your Bill Contact The Collector S

Help Balance The Massachusetts Budget With This Salt Workaround Stephan P Mcmahon Company

Did You Know Motor Vehicle Excise Tax

State Recreational Marijuana Taxes 2021 Tax Foundation

2022 Motor Vehicle Excise Bills Issued 3 3 2022 Due 4 4 2022 Rutland Ma