what is fit on a pay stub

Depending on where youre employed and which province or territory youre working in you may see other deductions on your pay stub such as. It gets removed from your pay added to the Social Security Tax on Medicare Tax Social Security Tax on Wages.

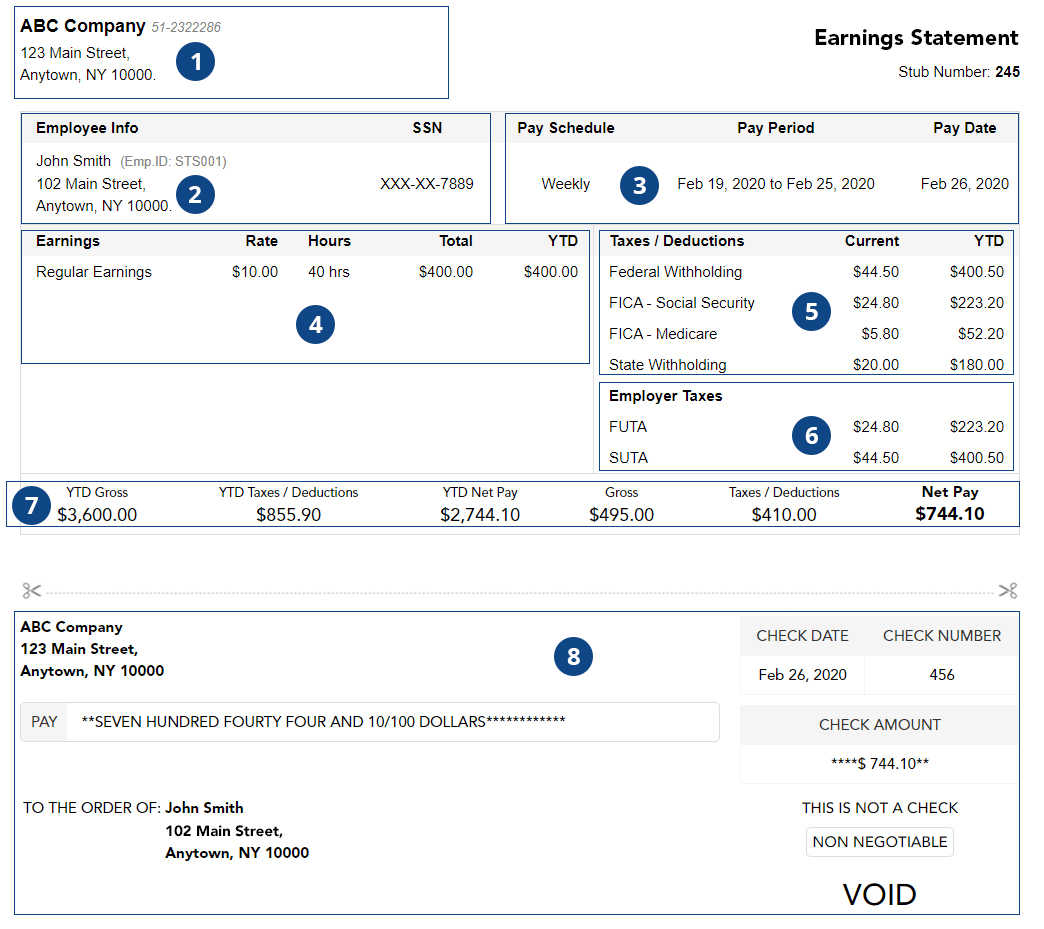

With Free Pay Stub Generator You Can Make Free Paycheck Stubs And Can Get A Chance To Make 1st Stub Free Give It A T Payroll Template Templates Free Checking

FICA would be Social Security and Medicare which are not deductions nor credits on your income tax return.

. But when you are trying to decipher it all it can look pretty intimidating. You will receive a pay stub for each pay period. FIT on a pay stub stands for federal income tax.

These items go on your income tax return as payments against your income tax liability. Your net income gets calculated by removing all the deductions. Paycheck stubs are normally divided into 4 sections.

The name of the Employee. FIT on a pay stub stands for federal income tax. FITW is an abbreviation for federal income tax withholding Youll sometimes see it on payroll stubs to identify your withholding deductions.

FIT is the amount required by law for employers to withhold from wages to pay taxes. The pay stub will show the gross pay the deductions taken out of the gross pay and the net pay. FIT Fed Income Tax SIT State Income Tax.

You pay 62 of your income to Social Security SS. These are the most common ones. What is FMED on my paycheck.

Its calculated using the following information. Federal income tax deduction can be abbreviated FIT deduction. Employees federal withholding allowance amount.

FICA stands for Federal Insurance Contribution Act. Take a look at your pay stubany amount labeled as FICA is a contribution to those two federal programs. The employee can adjust the FIT deduction by filing a W-4 however paying below true tax liability may result in a fine when filing taxes.

It shows your total earnings for the pay period deductions from. Fit stands for Federal Income Tax Withheld. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes.

A pay stub also known as a paycheck stub or pay slip is the document that itemizes how much employees are paid. Should I Claim 0 or 1 If I am Married. This is the amount of money an employer needs to withhold from an employees income in order to pay taxes.

You are going to see several abbreviations on your paycheck. Withholding is one way of paying income taxes to the. This is just a way to save time and space on your pay stub.

The taxable wages for federal tax for withholding purposes is gotten by taking the gross pay and removing any exclusion that may. One withholding employees see listed on their earnings statements is the Fed MEDEE Tax. Federal income tax deduction refers to the amount of federal income taxes withheld from an employees paycheck each pay cycle.

FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. How much you can expect to come out of your paycheck in federal income taxes depends on your age filing status and level of income you earn. What is fit WH on my paycheck.

Here are some of the general pay stub abbreviations that you will run into on any pay stub. All pay stubs need to have information including the employees details employer information gross pay. Fit stands for Federal Income Tax Withheld.

In the United States federal income tax is determined by the Internal Revenue Service. Federal income tax FIT is withheld from employee earnings each payroll. How much you can expect to come out of your paycheck in federal income taxes depends on your age filing status and level of income you earn.

Should I claim 0 or 1 if I am married. In the united states federal income tax is determined by the internal revenue service. Some check stubs break out Social Security and Medicare payments to show you how much youre contributing to each fund.

FIT deductions are typically one of the largest deductions on an earnings statement. A company specific employee identification number. While the task of figuring out FIT withholdings for your employees may seem tricky with the help of Block Advisors payroll service or payroll software like Wave your payroll to-dos just got easier.

FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. They are all different taxes withheld. You will not need to spend time calculating the individual percentages of all different types of deductions and withholdings.

A paycheck stub summarizes how your total earnings were distributed. Some are income tax withholding. FIT deductions are typically one of the largest deductions on an earnings statement.

A paycheck stub summarizes how your total earnings were distributed. Personal and Check Information. This is the amount of money an employer needs to withhold from an employees income in order to pay taxes.

On your pay stub youll see some common payroll abbreviations and some that arent so common. This is an important one to look at especially. Your net income gets calculated by removing all the deductions.

Heres the lowdown on FICA. Paycheck stubs are normally divided into 4 sections. The information on a paystub includes how much was paid on your behalf in taxes how much was deducted for benefits and the total amount that was paid to you after taxes and deductions were taken.

Transfer Fees mainly for Registered Savings Plans How To Read The Abbreviations On Your Pay Stub. Decoding Pay Stub Abbreviations. This amount is based on information provided on the employees W-4.

FIT deductions are typically one of the largest deductions on an earnings statement. General Pay Stub Abbreviations. It gets removed from your pay added to the Social Security Tax on Medicare Tax Social Security Tax on Wages.

The net pay is calculated by totaling the gross pay and then subtracting any deductions. However if you still feel that you can add something of value to your pay stub then you can customize your template to fit your needs. Fit stands for federal income tax.

FIT is withheld from an employees paycheck based on the amount of their federal taxable wages. The Employees social security number.

Create Pay Stubs Regular Pay Stub Professional Check Stubs Stubcheck Payroll Template Online Checks Regular

A Guide On How To Read Your Pay Stub Accupay Systems

Different Types Of Payroll Deductions Gusto

Deciphering Your Paycheck 10 Things To Know America Within Education Lessons Business Education Federal Income Tax

A Construction Paycheck Explained Example Pay Stub

What Everything On Your Pay Stub Means Money

Understanding Pay Stub Understanding Paycheck Stub

Hrpaych Yeartodate Payroll Services Washington State University

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp